Gift Planning Newsletter

Gift Planning Newsletter

Fall 2022

view

- A gift that pays you back—now with higher rates!

- Planning for Retirement and for Trinity

- Samples of Increased Annuity Rates

Gift Planning Newsletter

Gift Planning Newsletter

Fall 2021

view

- “Impact Now and Later” Peter Donovan ’75

- “Keep the Path Open” Robert Coykendall ’59

- The “Blended Gift Plan” – Good For You, Good For Trinity

- The Charitable Remainder Unitrust

Gift Planning Newsletter

Gift Planning Newsletter

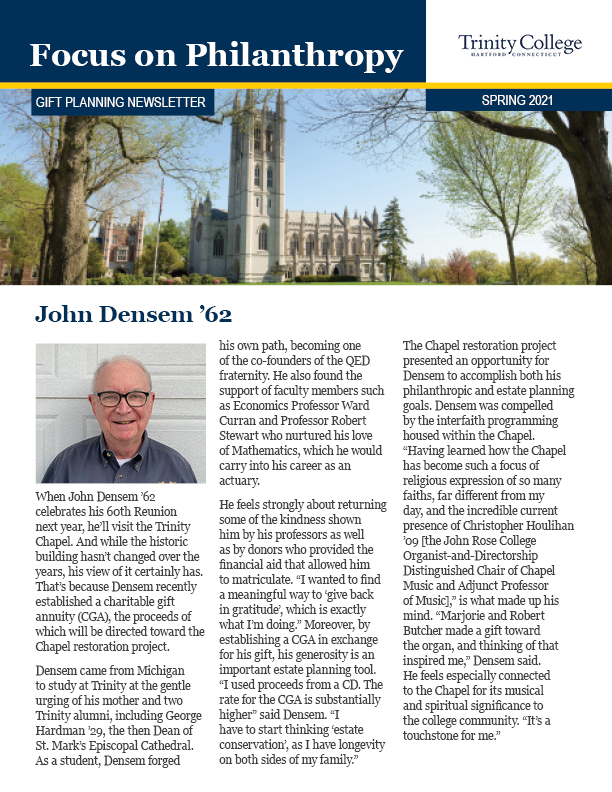

Spring 2021

view

- John Densem ’62

- Support to Trinity, Payments for You

- The IRA and Charitable Giving–A Perfect Match!

Gift Planning Newsletter

Gift Planning Newsletter

Fall 2020

view

- Elaine Patterson ’76

- Charitable Gift Annuity Provides Support to Trinity and Payments to You

- Your Loved Ones, Your Values, Your Legacy

Gift Planning Newsletter

Gift Planning Newsletter

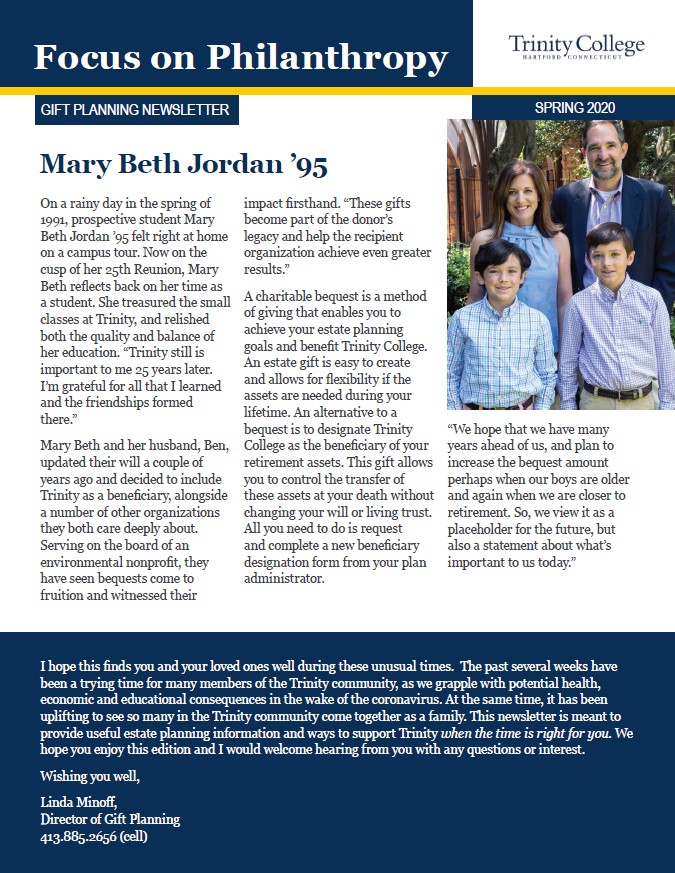

Spring 2020

view

- Mary Beth Jordan ’95

- Legislative Updates

- Increase Your Impact

Gift Planning Newsletter

Gift Planning Newsletter

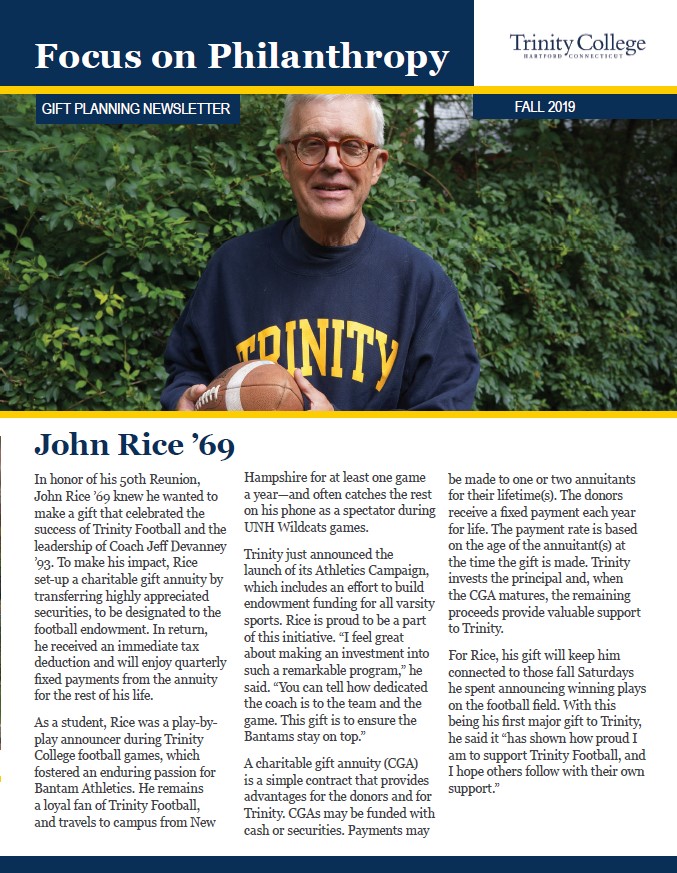

Fall 2019

view

- John Rice ’69

- Including Deferred Gift Annuities in Your Retirement Planning

- This Year, Consider a Gift to Education

Gift Planning Newsletter

Gift Planning Newsletter

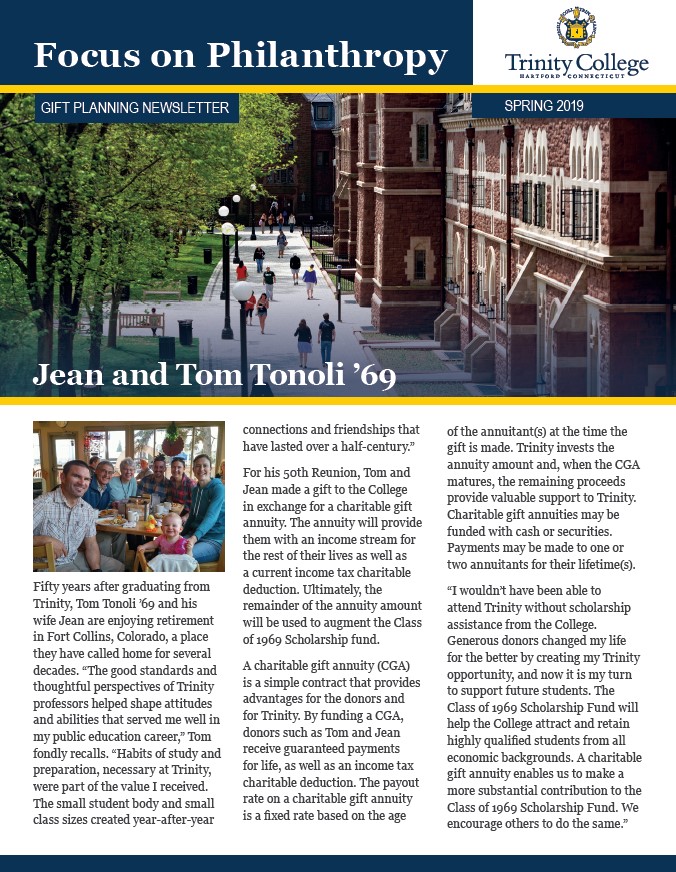

Spring 2019

view

- Jean and Tom Tonoli ’69

- Charitable Giving—It’s More Than Just a Tax Deduction

- Charitable Gift Annuities: Income for You, Support for Trinity College

Gift Planning Newsletter

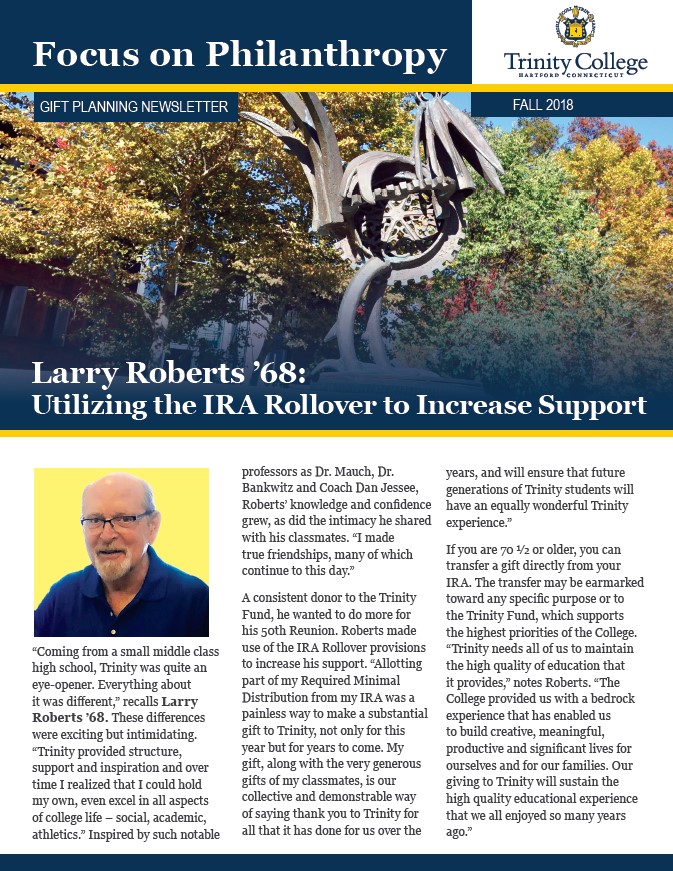

Gift Planning Newsletter

Fall 2018

view

- Larry Roberts ’68: Utilizing the IRA Rollover to Increase Support

- Charitable Giving After Tax Reform? Consider Your IRA

- Charitable Giving at Year-end

Gift Planning Newsletter

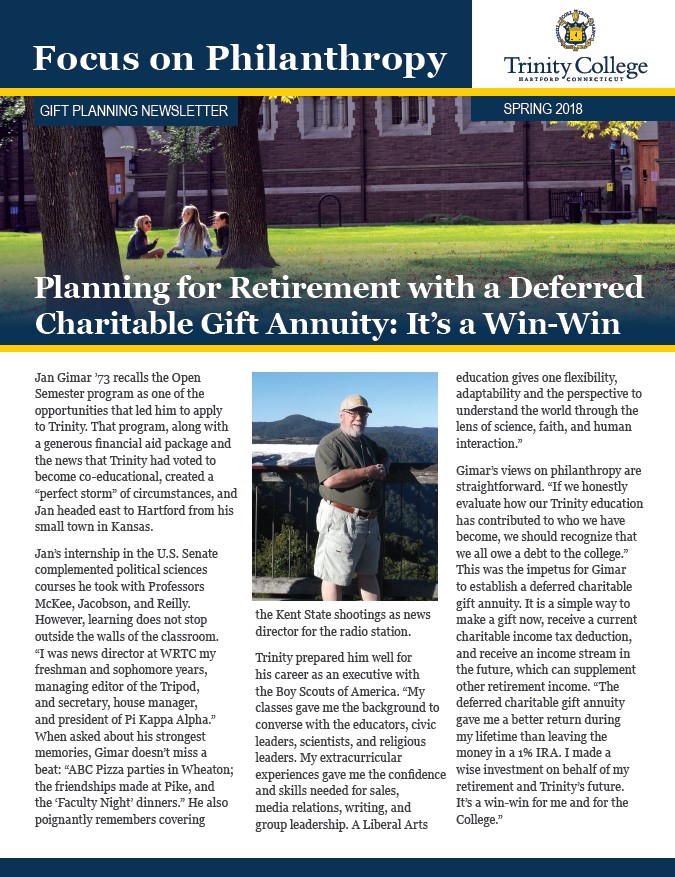

Gift Planning Newsletter

Spring 2018

view

- Planning for Retirement with a Deferred Charitable Gift Annuity: It’s a Win-Win

- Retirement 101: A Beginner’s Guide to Retirement

- Closing the Financial Gap

Gift Planning Newsletter

Gift Planning Newsletter

Fall 2017

view

- Greetings from Gift Planning

- Donor Highlight: Bob Ebinger ’67

- Why Make Charitable Bequests?

- Beat the Clock at Year-End